The fundamentals of Investing Strategies

Are you dealing with the subject of investment strategy for the first time? Or do you want to realign your investment strategy, but don't know how? Customers of branch banks are sure to know what their investment advisor said: "A lot has happened, a lot is happening at the moment and more will happen - we have to take countermeasures with your portfolio". Translated, this means nothing other than "I have sales pressure and have to turn your depot, no matter how."

We want to show you here how you can develop your own investment strategy that meets your needs, not those of the people in the bank. Investors differ in terms of their investment mentality. The cautious will focus on time deposits and overnight money. Its counterpart, the opportunity investor, tends to turn to contracts for difference, or options.

What is the difference between depot and portfolio?

At this point we want to make a distinction between a depot and a portfolio, as both terms are often used synonymously. The custody account refers purely to the safekeeping and administration of securities . It is part of the overall investment portfolio. A portfolio, on the other hand, is made up of many different investment options :

- Deposits (call money, time deposit, savings account)

- Securities account (shares, bonds, funds, certificates)

- property

- precious metals and precious stones

- art objects

Basically, an investor's portfolio can contain anything that he expects to add value to in the short or long term.

Contracts for difference (CFDs) and foreign exchange trading (Forex) are a little left out here, as they are not classic forms of investment, but short-term trading. The contracts are usually closed on the day they were opened. However, this form of trading can be understood as an accompanying action for classic portfolio building.

In this article, however, when we talk about a portfolio, we want to limit ourselves to securities and deposits.

Why is a division of assets useful?

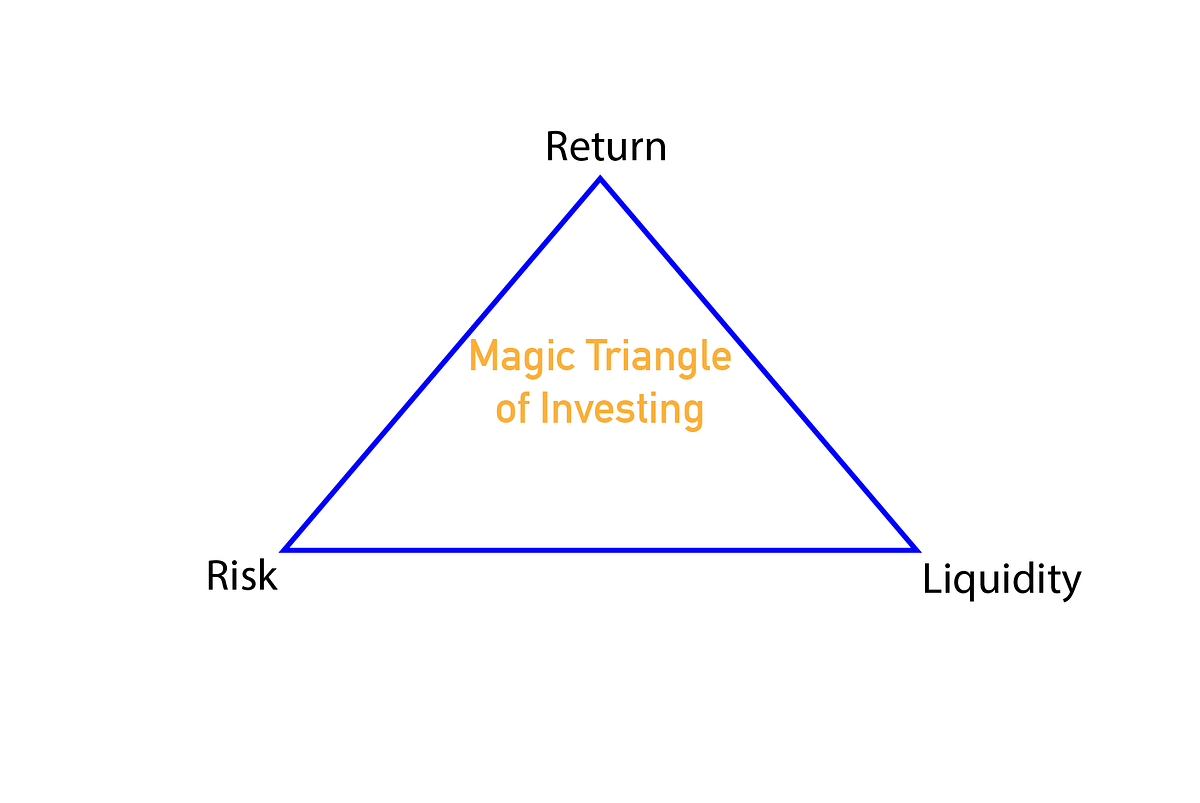

Anyone who deals with investing money beyond overnight money for the first time quickly realizes that they are moving in an area of conflict known as the magic triangle

|

| This graphic shows the magic triangle for financial investments, |

The safer an investment is and the easier it is for the investor to dispose of it, the lower the return . On the other hand, the return also includes the risk. An option, for example, offers high profits, but can also lead to a total loss of the capital invested.

The individual investment strategy therefore takes into account the need for security, the investment horizon and the expected return of the investor . Liquidity should always be ensured by a financial cushion in the context of a call money account. The idea that stocks can be sold every trading day is correct, but it doesn't take into account the fact that prices can collapse on that particular day.

It starts with self-assessment

Before designing or reorganizing a portfolio, every investor should ask themselves a few questions in order to divide up the term and availability of the assets accordingly as part of their investment strategy.

- How long can parts of my investment be invested, when might I need money?

- Do I want high returns and do I also accept temporary or complete losses?

- Am I frugal in terms of earnings, but do I have the greatest possible security?

- What experience do I have with securities and financial investments?

According to Section 34 of the Securities Trading Act [1] , on-site consultants are obliged to ask these questions as part of the consultation minutes. Online banks also require a self-disclosure in accordance with applicable law in your country .

Securities are divided into seven risk

classes, for example: from euro money market funds with risk class 1 to hedge or

sector funds with risk class 7. Shares from the DAX40 and the M-Dax, for

example, fall into risk class 4, which stands for "solid

earnings-oriented". Euro

bonds with a good credit rating in risk class 3. Investment funds

reflect the risk class that corresponds to the majority of the

individual titles contained in the fund.

According to the self-assessment, the theoretical division of the portfolio is now different. The composition of an investment portfolio is of course not set in stone, but only those who have a plan can change it.

The categorization of securities into different risk classes contrasts with the classification of investors into three different investor mentalities :

- The conservative investor who values security over returns.

- The "balanced" investor who primarily relies on security, but also appreciates an admixture with an above-average risk-reward profile.

- The dynamic investor who consciously relies on a high opportunity-risk profile.

For the average investor, as so often in life, the sentence applies: "It's in the mix."

Risk classification of investment instruments

Investments or investment instruments can not only be divided into different risk classes, but also have different individual risks. The three most important risks of any investment are as follows:

- Default risk

The default risk describes the risk that an investor suffers a partial or total loss of his investment – for example if the debtor becomes insolvent. - Liquidity risk

Liquidity risk describes the risk that an investment cannot be liquidated at the desired time or at least not in the short term or only at a discount to its actual value or at high costs – for example a property that is to be or must be sold in the midst of an economic downturn. - Market price

risk The market price risk describes the risk that the market price of the investment falls temporarily or permanently – for example a share in a weak stock market phase. The market price risk thus also includes the interest rate risk.

Our infographic below shows which investment instruments are subject to the three risks mentioned and to what extent:

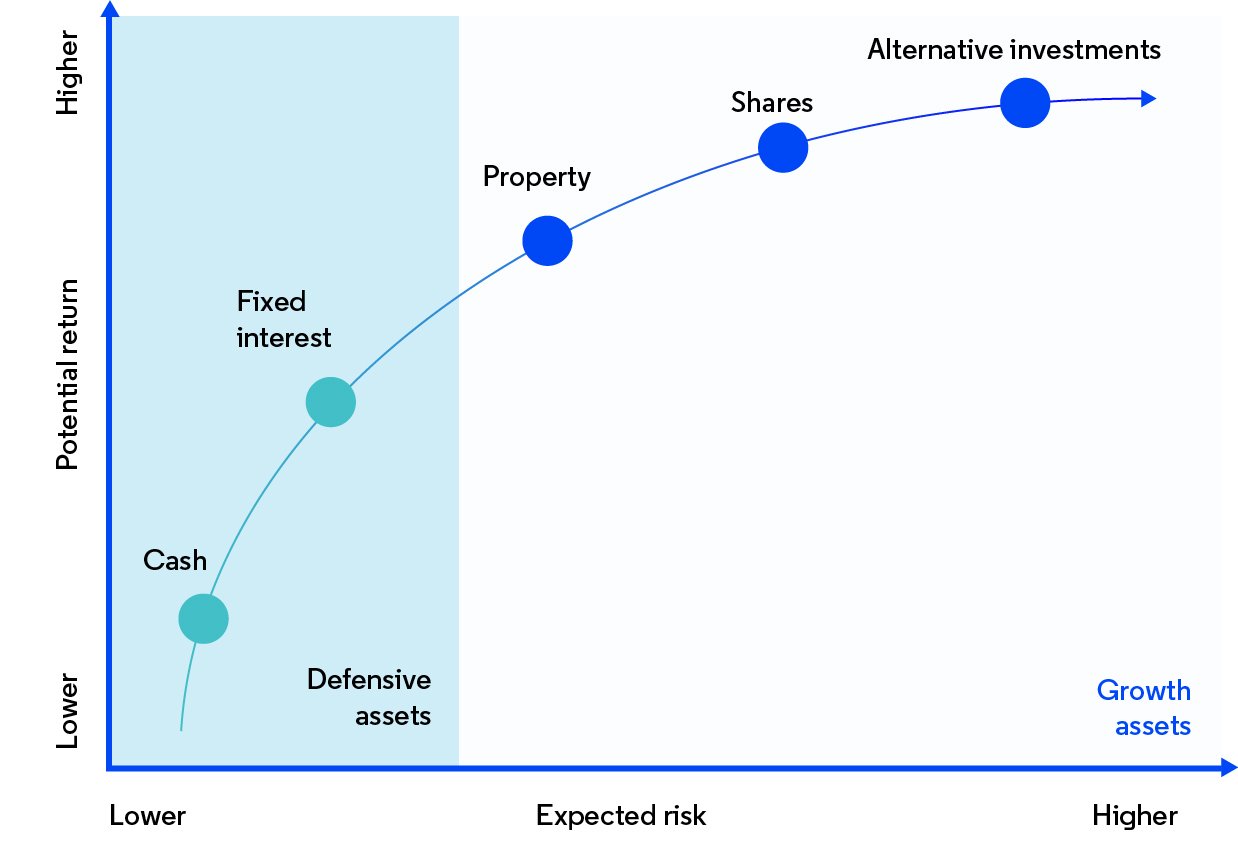

Higher risk for higher returns

A higher return usually comes with a higher risk. In response to this almost truism, the banking association asked an interesting question in its investor survey conducted in December 2019: "Could you imagine taking on a higher investment risk for a higher return?". More than half of the investors answered “not at all”, and only three percent “very well”. But what is really interesting is the development over time: while in 2015 72 percent of investors could not imagine taking higher risks, this figure has now fallen to just 53 percent:

There are many investment opportunities - spoiled for choice

The investment strategy and the composition of the portfolio result from the knowledge of which type of investor you belong to and which terms are possible for an investment.

Basically, cash reserves in the form of overnight money are a must. Without holding liquidity, every investor risks having to sell at a bad time. The investments should take into account the following time horizons:

- Daily money is available at any time.

- Equities and equity funds can be sold every trading day, they are recommended for medium to long-term investments from five years.

- Although fixed-income securities can be sold every trading day, the holding period should be based on the term of the security.

- Standard certificates usually have terms of between 12 and 18 months.

- The investor decides on the term of time deposits himself, during the term he cannot dispose of them.

First of all, the main question is whether securities are invested in individual titles or in funds. Individual titles have the advantage that they are cheaper, with funds, the management selects the stocks or bonds . The easiest way is to invest in so-called ETFs, Exchange Traded Funds, in German index funds. We have dedicated a separate chapter to this type of fund and therefore do not want to go into it any further at this point.

Of course, the return is a key factor in the investment strategy. While some investors tend to focus on so-called dividend stocks, others speculate on price gains. In theory, the conservative dividend stocks include the stocks in the DAX and M-DAX. In January 2016, the shareholders of Deutsche Bank AG experienced that this can also be a fallacy. The company, actually very conservative, did not pay out a dividend in 2015, in 2016 only 19 cents and also moved in this range in the following years. Things have looked similarly lean at Commerzbank for years.

Of course, market conditions also play a role in determining the investment strategy . The past few years have shown that even conservative investors have fared better with equities than with fixed-interest securities. A rethink and a reorientation was necessary here in order to avoid losses.

In principle, therefore, it applies to every portfolio that a splitting of the assets is required. On the one hand to find the ideal risk-return mix , on the other hand to optimally exploit the market conditions. But how could a portfolio, according to the respective type of investor, look roughly outlined.

A Comparison of the Various Investment Strategies

A word about certificates

No matter what investment strategy an investor pursues, local bankers never tire and want to add certificates. The reason is that certificates for banks mean recurring commission income due to the short terms. The following features apply to most certificates:

- Fixed rate

- Yield only becomes interesting with a bonus

- Relatively short term

- entry fee

- Backed by a share or a basket of shares

Time and again, certificates were sold to uninformed investors as fixed-income securities. At first glance this is correct. However, certain “rules of the game” apply to the underlying shares or share baskets. If the price of these shares develops contrary to the issuer's specifications during the term, the bonus is void, in the worst case there is a risk of total loss, as the Lehman bankruptcy proved.

Even if certificates are "fixed-interest securities", they have no place within the framework of a conservative investment strategy.

value or growth?

Behind these two terms are the two basic approaches of an investment strategy . "Value" is aimed at a long-term strategy. Examples of value stocks are Daimler or Coca-Cola. “Growth” papers are shares in companies that hardly ever pay out dividends, but stimulate enormous price fantasies, for example through a patent on an innovation. The best example of an investment in growth stocks was the technology hype at the turn of the millennium, which burst on March 15, 2000 with a huge bubble. Value stocks are ideal for conservative investors with a long-term investment horizon. Growth papers are more suitable for risk-averse investors.

Warren Buffet, one of the most successful investors of our time and CEO of the investment company Birkshire Hathaway, once described his investment strategy as follows: As long as there were children, people would drink cola and eat hamburgers. As long as there were men, most of them would shave.

What he aimed for was that he prefers to invest in value stocks, in these examples Coca-Cola, McDonalds or Gilette. The bursting of the techno bubble in 2000 didn't really affect the man from Omaha, Nebraska and the shareholders of Birkshire Hathaway.

Anyone thinking about their personal investment strategy should keep Warren Buffet in mind, as the online edition of the magazine “Der Westen” from February 27, 2016 suggests. [3]

After this rather comprehensive introduction to the topic of "investment strategy", we would like to present the options available to you for implementing an investment strategy in the next section.

Once you have defined your own position in terms of the opportunity-risk profile and the periods for which funds can be invested have been determined, it is now a matter of putting the investment strategy into practice and creating a portfolio.

There are three alternatives for this step :

- The investor entrusts his money to an asset manager or a bank .

- After intensive reading of specialist magazines and the selection of investment objects, the investor opens a securities account and begins to build up the portfolio himself .

- As a beginner, he doesn't want to take any risks, but also doesn't want to spend unnecessary money on advice. He opts for a robo-advisor .

Fear not, we will explain in detail what a robo advisor is and how it works. First, let's look at traditional methods of portfolio construction.

How does investing through an asset manager or bank work?

We have already commented on the subject of investment advice at banks in the first part. In branch business, the customer's individual investment strategy usually takes second place to the sales pressure exerted by the advisor . The products that are the focus of the sales measures are sold. Developing an investment strategy with a bank advisor means for the layman that he usually has to deal with commission-intensive products, funds with a full front-end load and certificates.

Almost all fund companies today offer some kind of asset management within the framework of funds of funds , which in turn are sold by the associated banks. These funds of funds are based on the respective risk classes. If it is a conservative fund of funds, funds with bonds and conservative stocks make up the lion's share.

For the investor, this variant means issue fees on the one hand and quite high administration costs on the other . The advantage is that an investment strategy can also be pursued as part of a savings plan.

Wealth managers do not receive any commission, but work on a fee basis. However, asset managers require a certain initial volume, and savings plans are rarely offered.

What should you watch out for on your own path?

While asset managers and robo-advisors already offer custody accounts, the individual solution first requires the search for a suitable custody account . Numerous direct banks and online brokers now waive a custody account management fee. When choosing a custodian bank, it depends on which securities are to be included in the investment strategy.

If the focus is on investment funds, we recommend a partner who largely waives the front- end load . If shares of German companies or bonds are in the foreground, the provider does not have to enable trading on 30 international stock exchanges. In this case, a low brokerage fee is more important. There are certainly brokers who do not charge a percentage commission based on the order volume, but offer flat rates, for example 4.95 euros for trading in German shares. Regardless of how the investment strategy is structured, at the end of the day it is the net return that counts, i.e. the income that remains with the investor after deducting taxes and costs. With a clever selection of the broker, depending on the trading volume, you can save several hundred euros a year.

However, your own investment strategy based on individual values can be very time-consuming . Investors need to keep themselves up to date in order to make any changes in the portfolio. It makes more sense to rely on funds and index funds in the long term.

What do robo advisors do?

RoboAdvisors are a relatively new form of virtual wealth management . This variant is based on investing in ETFs , passive funds, although shares and active funds can also be used. According to the specified risk profile, customer funds are invested in a portfolio with the appropriate fund composition. The compilation of the respective investment strategy is not based on arbitrary, subjective decisions by the management, but on financial mathematical models .

The term robo-advice can therefore be translated as "machine recommendation" in the broadest sense. The advantage of this approach is that on the one hand it is very cost-effective and on the other hand the customer is completely detached from the sales pressure of the bank advisors on site or from their own time spent on research.

Which variant is suitable for whom?

To be honest, traditional on-site banking advice is basically obsolete . Of course, it cannot be formulated in general terms, but experience has shown that objective advice on investment strategy hardly ever takes place.

Asset managers are actually only suitable for those who have larger assets at their disposal and the tax component plays an important role in the investment strategy.

The self-defined investment strategy and its implementation is suitable for those who already have experience in the field of investments or really want to gain it from scratch. However, observing the markets and continuously reading analysts' opinions and recommendations is quite time-consuming.

Finally, have you heard of Simple Option Trade Alerts?

I'm giving away a FREE 5-day training series that will show you how to make big profits with little options... in 10 days or less.

.jpg)

No comments:

Post a Comment